Top 5 Strategies for Harnessing Social Listening in the Financial Industry

In the wake of recent bank failures, it is important to emphasize the significance of social media as an ‘early-warning’ system for companies. Particularly within the ever-changing fintech environment, financial institutions must effectively utilize social media to understand market changes and consumer trends, stay up-to-date on industry developments, and secure a competitive advantage.

The financial industry is experiencing unprecedented transformation, driven by disruptive factors such as digitization, cybercrime, fraud, data security, product innovation, sustainability requirements, and an unstable economic landscape. These challenges impact all participants in the financial arena, from commercial organizations to regulatory bodies.

In this dynamic environment, adaptability, agility, and speed to insight are the keys to success for thriving companies. Thankfully, financial institutions no longer need to rely solely on time-consuming surveys, focus groups, or direct email interactions to understand their audience. Finally, social intelligence has emerged as a powerful, cost-effective, and efficient method that can provide insightful real-time data with less effort. Couple that with AI-backed technology, and it is a game changer!

Every day, internet users engage with social networking sites, forums, and online communities to share their thoughts on the abovementioned topics. These online conversations offer a treasure trove of information for retail banks and financial businesses, helping them understand consumers’ thoughts, emotions, behaviors, and actions.

Although the financial industry tends to have a myopic view of data-gathering methods, here are five ways financial institutions can capitalize on social intelligence to achieve maximum results.

1) Gain Market Insights through Organic Conversations

Social media platforms offer unsolicited opinions and candid thoughts from your audience. By analyzing these conversations, financial institutions can understand their customers’ challenges and goals without relying on time-consuming surveys. Active social listening is vital for any business seeking to grow and improve.

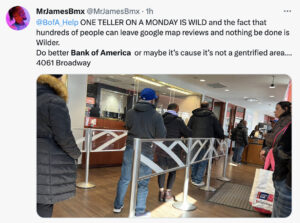

In the example below, an upset consumer shares their disappointment with one Bank of America location, even leaving the address of the bank. Posts like this allow the bank to dive into the issues at this location and improve its operations. In addition, by reaching out to the consumer who posted this, the bank shows it cares about its consumers and actively listens to their feedback.

2) Stay Informed on Trends and Innovations

Financial institutions must constantly adapt to industry innovations and emerging trends. Social listening can help track these changes quickly, giving financial institutions a competitive edge. In addition, keeping an eye on the latest advancements in areas like cybersecurity and data breaches can help institutions maintain trust and deliver exceptional customer experiences.

Many social listening tools allow brands to set up alerts for keywords spike in volume or sentiment. The tweet below is an excellent example of why banks and fintech organizations should be monitoring social. By setting up a dashboard that monitors keywords like “banking trojan” or “bank data breach,” brands can be notified in real time if an issue could affect their operations.

3) Share Relevant Content to Engage Your Audience

Understanding your audience’s needs and interests is critical to sharing valuable content. Financial institutions should focus on sharing service updates, security updates, promotions, industry news, corporate news, and fun facts to keep their audience engaged and informed. Always prioritize content that matches your audience’s needs and interests.

Ally Bank is an example of a financial institution with a fun yet informative voice on social media. Beyond posting financial tips, commenting on trending topics, sharing memes, or sharing about its services, the brand goes the extra mile to engage its audience while simultaneously taking their feedback and turning it into content.

4) Capitalize on Online Reviews and Feedback

94% of consumers check online reviews before making a purchase decision. With thousands of online review sites, manually checking sites for consumer feedback is tedious and time-consuming. Enter -> Social Listening. These tools empower financial institutions to source and leverage consumer reviews, positive and negative, to showcase their commitment to customer satisfaction.

Websites like Consumer Affairs are great places to analyze consumer feedback on your brand and competitors. By looking at the data over time, you can see how issues trend, identify addressable areas, and promote areas your brand excels in. Customer recommendations also make great content!

On brand social posts, respond promptly and be helpful when consumers leave negative feedback. In doing so, you can turn unhappy customers into loyal advocates, ultimately increasing retention rates.

5) Learn from Competitors’ Strategies

Monitoring competitors through social listening is essential for evaluating your brand’s performance. With 77% of businesses using social listening to track their competitors, staying informed about their actions and strategies is crucial. By comparing your efforts against the competition and analyzing competitor feedback, you can identify areas for improvement and deliver the best possible service to your customers.

A Final Note on Compliance

While we’ve discussed the top 5 strategies, it’s essential to touch on compliance as electronic communication in the financial industry is heavily regulated and subject to stringent regulations by the Federal Financial Institutions Examination Council (FFIEC). Compliance is not just about your brand’s social media posts but also your responses and interactions on these platforms. Therefore, it is vital to stay informed about compliance requirements and protocols. Proactively document consumer comments and your responses on third-party websites, exporting these reports as PDFs. Store these reports in a secure location, making it easy to present archived materials if you ever face an audit.

Also, pay attention to and monitor accounts impersonating your brand on other websites or social profiles, and promptly report any suspicious activity. Your community members often will alert you to these fake accounts, so a listening strategy to help capture this information is critical.

What This Mean For Banks & Financial Institutions

Consumers increasingly face sophisticated scams and fraudulent activities online and offline. That is why they seek trust and transparency from their banks and financial institutions. Building confidence that a bank genuinely prioritizes its customers’ best interests is vital for maintaining strong customer relationships. Authentic and empathetic brands can gain a competitive edge if their offerings align with genuine consumer needs and expectations. Social listening can help uncover this.

To assist in navigating this evolving market, B3 has collaborated with numerous financial institutions, providing insights and solutions for the banking industry’s most pressing concerns. Our services encompass strategic intelligence reports crafted by social intelligence experts that delve into current trends, emerging behaviors, and popular topics. Additionally, we create real-time, custom-built banking dashboards for our clients. By merging the most comprehensive array of online and offline data sources, AI technology, and the latest analytical frameworks, our team can help you uncover the potential impact of the latest consumer and market shifts on your sector and brand.